W 4 Single And 0

Do you know how many allowances you should be claiming on your W-4 for tax purposes? Should you claim 0 allowances, should you claim 1 allowance, or should you claim more than 1 allowances? Are you asking yourself “should I claim 1 or 0”?One of the big changes you can do is adjust the number of allowances you claim on your W-4.

I remember my first job ever. I came into my first day of work, all happy and bouncy.

I met with HR and got handed a folder about 1 inch thick of paperwork I had to fill out.

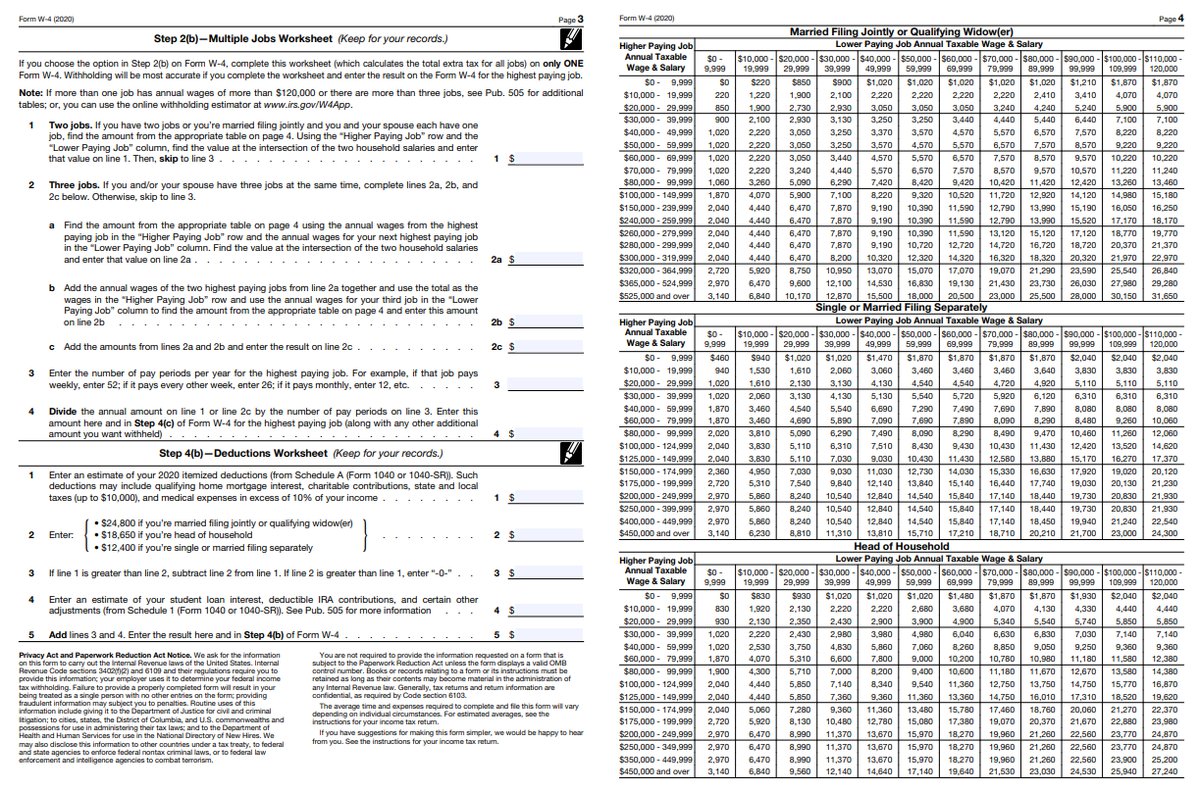

Wire & Cable Your Way offers a wide selection of Single- and Multi-Conductor Type W Power Cable products low prices & fast shipping - available by the foot with no cut charges. Type W cable has an inherent resistance to oil and sunlight, coupled with a 2000V voltage capacity. The old W-4 proved to be difficult for those who worked two or three jobs, instead of just one, among other factors. More:4 reasons your tax refund won't reach your bank account More:New.

The poor HR lady must have seen the confusion and horror on my face.

She took pity on me and pull out just a few “essential papers” I needed to fill out on the spot.

One of those forms, the W-4.

Mind you, I had no clue what a W4 was and needless to say what an allowance was.

I vividly remember she asked me “Do you want more money or less money per paycheck”.

I was like “DUH” more money obviously. Who doesn’t?

She told me to write down 2 allowances and sign it.

Single And 0 On W 4

Little did I know the total number of allowances I was claiming would have huge tax implications for me.

Do you know the total number of allowances you are claiming? If you thinking “How many allowances should I claim” keep reading because I go into details on how to maximizes your taxes by claiming a certain number of allowances.

What is a W-4 Form?

The Employee’s Withholding Allowance Certificate is most commonly know as a W-4. It is an Internal Revenue Service (IRS) tax form that a person (employee) fills out to let the employer know how much taxes should be withheld from their paycheck.

You can download the form from the IRS website.

A W-4 is a form that every employee has to file.

It is a requirement from the US government.

This is how the employer knows how much federal income taxes should be withheld from your paycheck.

Employers are required by law to report new employees to a designated State Directory of New Hires.

W 4 Single And 0

What are Allowances on W4?

W4 allowances are the number of people you are claiming.

W 4 Single 0 Allowances

The number of allowances determines the amount of money the employer takes out of your paycheck.